Indian Used Car Market Trends: Growth, Shifting Preferences, and Future Outlook

Published On 10/1/2025, 1:08:29 pm Author Uttkarsh SinghThe Indian used car market is witnessing a significant shift, with the new-to-used car ratio now standing at 1:2.2. This means that for every ten new cars sold, there are 22 used cars available for purchase. The ratio was previously 1:1.2 a few years ago, reflecting the growing confidence in the used car segment. Let's understand this

In first-world countries like the USA, Canada, and Dubai, the used car market is highly mature and well-organized. Many brands themselves offer refurbished cars, ensuring quality and reliability. Multi-brand used car showrooms have become common, providing consumers with a wide range of choices under one roof. The market is supported by strict regulations, transparent pricing, and warranties, making the entire buying experience smoother. Unlike India, these countries do not have restrictive policies like the 15-year-old vehicle rule, which often limits the lifespan of cars in certain regions. Consumer behavior in these markets is also different, as buyers typically prioritize vehicle history reports, certifications, and the peace of mind that comes with purchasing from established dealerships.

In India, the used car market is still largely unorganized and unregulated. A significant portion of transactions takes place through local mechanics, small brokers, or directly between car owners. The recent imposition of an 18% GST on used car sales from dealerships could further exacerbate the situation. This tax burden may push many sellers and buyers toward non-transparent or unfair deals, as they try to bypass the tax by engaging in black-market transactions.

Used Car Buying Behavior Across India's Tier 1, Tier 2, and Tier 3 Cities

Tier 1 Cities In Tier 1 cities, which typically include major metro hubs like Delhi, Mumbai, Bengaluru, and Chennai, the used car market has evolved into a more organized and formalized space. Buyers in these areas are generally more affluent and belong to professional backgrounds such as IT professionals, government employees, and business people with higher income levels. As a result, they tend to prefer transparency, traceable transactions, and clear documentation when purchasing a used car.

These buyers often look for convenience and minimal hassle in their car-buying journey. They prefer dealing with organized dealers who provide certified, refurbished cars, often with warranties or service packages. This segment is also more inclined to conduct thorough background checks, ensuring that they are not buying a vehicle with hidden defects. With higher disposable incomes, these buyers are willing to pay a premium for peace of mind and hassle-free transactions. They also expect technology-driven solutions, such as online platforms for browsing, reviewing, and purchasing cars, which add a layer of convenience and trust.

Tier 2 & 3Cities the behavior of used car buyers in Tier 2 and Tier 3 cities is markedly different. These areas are typically less developed in terms of organized retail and formal sectors. Most consumers in these regions belong to the unorganized sector—MSME (Micro, Small, and Medium Enterprises) business owners, blue-collar workers, and others who are not regular salaried employees. The primary driving factor for used car purchases in these cities is the need for mobility and convenience rather than a desire for luxury or brand prestige.

In these markets, buyers are less concerned with certifications or warranties and are more price-sensitive. A significant portion of the transactions is conducted through informal channels such as roadside garage mechanics, small car brokers, or even direct car-to-car sales between individuals. Trust is often built through relationships rather than formalized contracts or paperwork. While some buyers in these areas may eventually choose to work with organized dealers for added convenience, many prefer unregistered or independent sellers who offer lower prices and are willing to negotiate.

In fact, it's estimated that more than 90% of people in India work in the unorganized sector, and this demographic's car-buying behavior reflects their generally informal approach to transactions. They are more likely to rely on word-of-mouth, local connections, and face-to-face negotiations rather than seeking out a dealer with proper certifications.

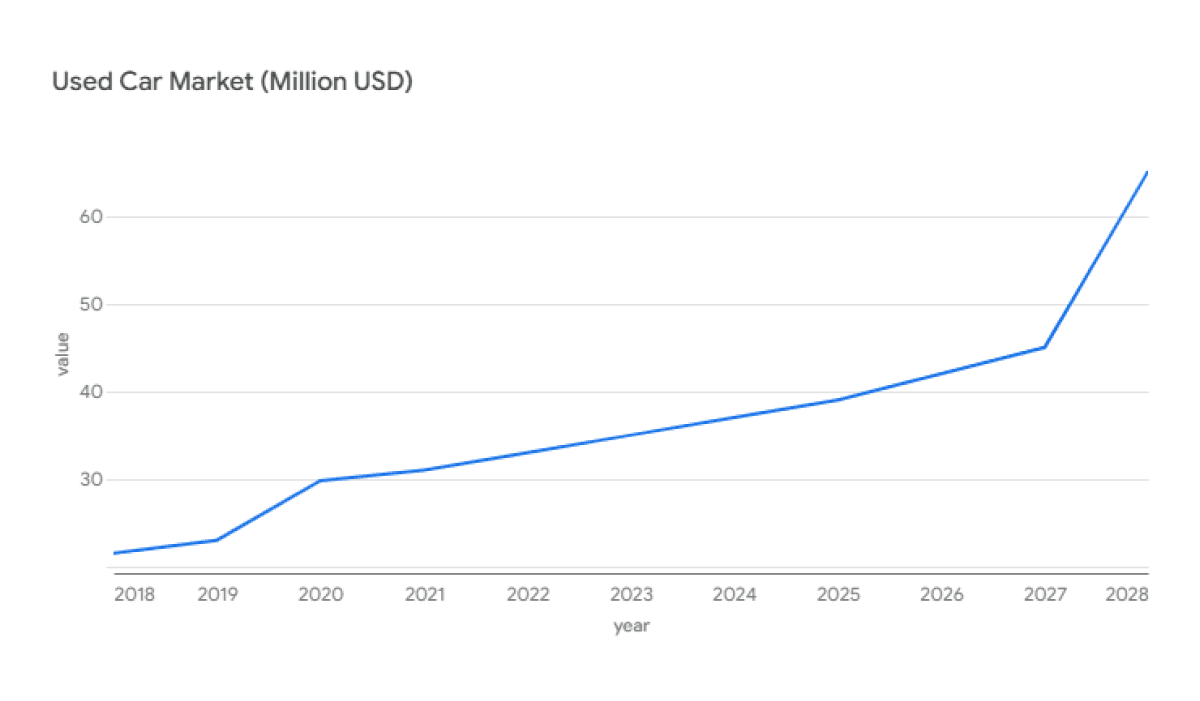

Used Car Market Trends in India

In recent years, there has been a substantial increase in the demand for used cars, particularly in non-metro regions. Non-metro areas now account for 65% of the used car demand, a significant rise from 55% over the past five years.

In Tier 1 cities, the used car market is becoming increasingly organized. The presence of organized dealers is expected to drive demand, offering consumers certified vehicles with warranties and transparent transactions. This trend is supported by the growing middle class and the increasing availability of financing options, making used cars more accessible to a broader segment of the population.

The shift towards used cars is even more pronounced in Tier 2 and Tier 3 cities. Currently, the demand for used cars in Tier 2 cities stands at 40%, and in Tier 3 cities at 25%, contributing to a combined 65% of the market share. This overall contribution is projected to reach 75% in the next four to five years.

Many consumers in India may continue buying used cars until they are ready to transition to electric vehicles by 2027 or 2028 due to several factors. While electric cars are gaining popularity, the high upfront cost, limited range, and insufficient charging infrastructure still make them less attractive to a large portion of the population. For budget-conscious buyers, used cars offer an affordable and immediate solution without the financial strain of new EVs. Additionally, in many regions, especially Tier 2 and Tier 3 cities, the transition to EVs is slower due to infrastructural and logistical barriers. Therefore, until EV options become more accessible, reliable, and cost-competitive, consumers will continue relying on used cars as a practical choice.