2024 car sales: Maruti Still Rules, but Tata Punches Above Its Weight in CY2024

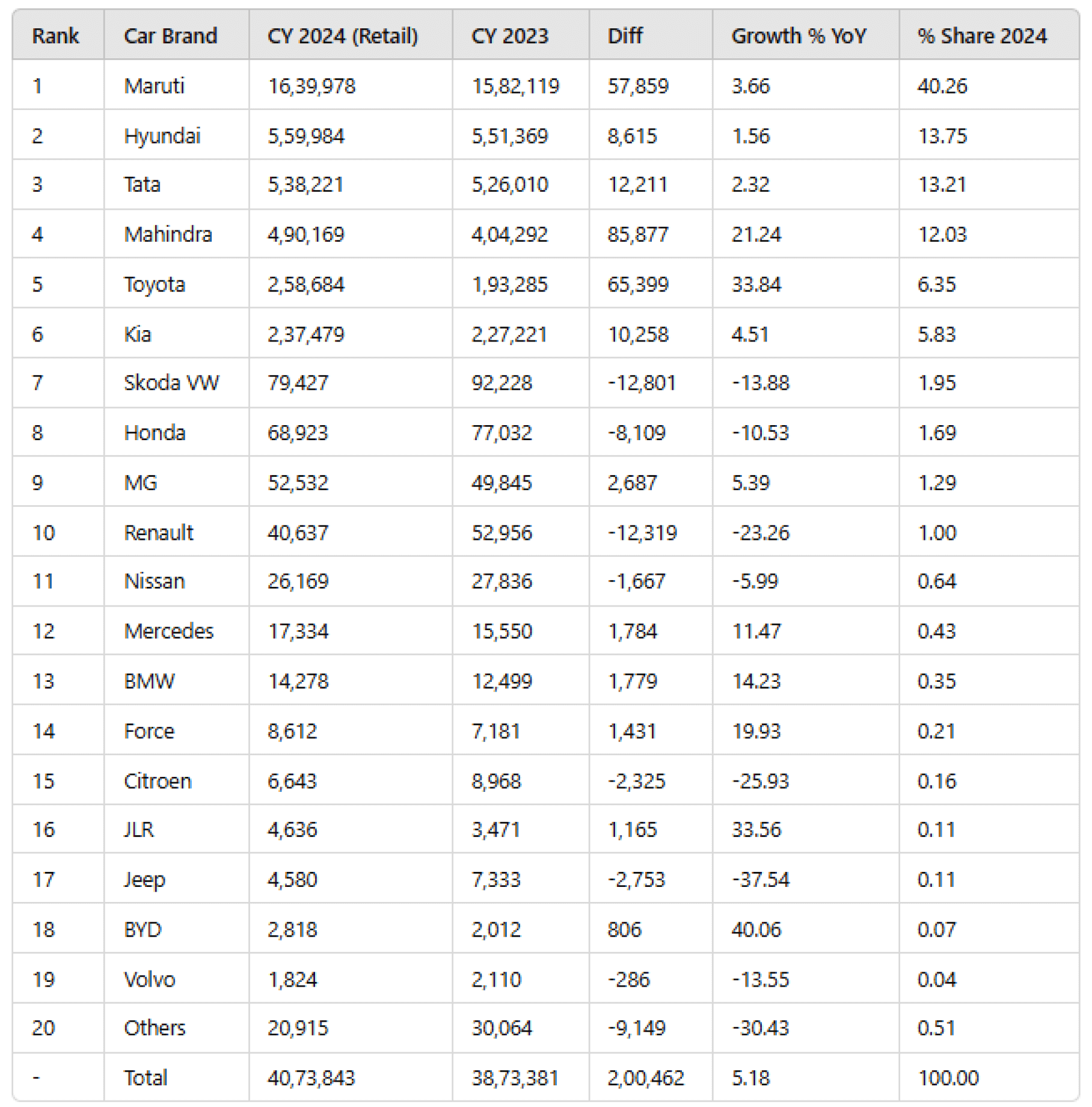

Published On 7/1/2025, 8:03:33 pm Author Zeeshan Ali AqudusAccording to FADA’s latest report, retail sales surged to 40,73,843 units in 2024. It is approximately 5% more than the sales recorded in 2023. Let's decode who is where.

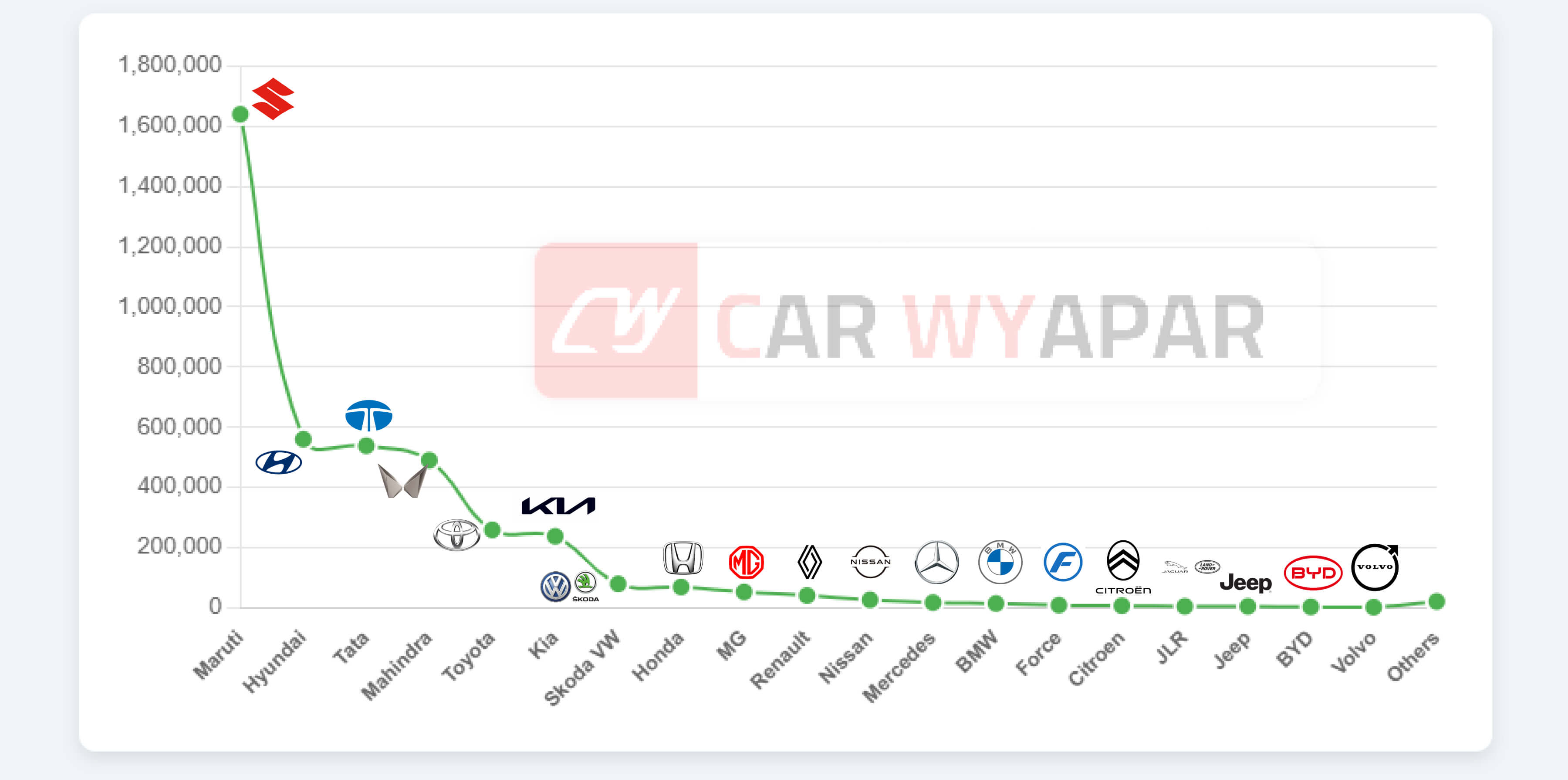

Maruti Suzuki has been the undisputed sales leader in India for decades, and CY2024 was no different. What sets Maruti apart isn’t just its dominance but the staggering gap it maintains over its nearest competitor. With 16,39,978 units sold, Maruti commanded a 40.26% market share, while Hyundai, in second place, managed just 5,59,984 units—a difference of nearly 34 percentage points!

While Hyundai holds the second spot, Tata Motors has quietly but steadily climbed the ranks over the past 5–6 years. With a focus on safety, electric vehicles (EVs), and innovation, Tata secured the third position in CY2024, selling 5,38,221 units and achieving a 13.21% market share. What’s striking is that Tata is now inching closer to Hyundai, with a difference of just about 21,000 units—a gap that seemed unthinkable just a few years ago because Tata was stuck with Bolt and Zest that gave commercial vibes.

The Surprise of 2024: Best Selling Car was NOT a Maruti!

However, there’s a twist in the narrative. Despite Maruti’s dominance, the title of the best-selling car of 2024 didn’t belong to Maruti. Instead, it was Tata Motors’ Punch, which sold a remarkable 202,030 units, outperforming the Maruti WagonR (190,855 units).

While the WagonR remains a sales juggernaut, it’s important to note that approximately 30-35% of WagonR sales are attributed to cab and fleet operators. The car’s low cost of ownership, excellent mileage, and reliability make it a top choice for commercial use. This indicates that the Punch’s success is not directly tied to competing with the WagonR.

Instead, the Tata Punch is capturing personal car buyers, particularly those who may have otherwise considered the Maruti Swift. Its rugged SUV-like stance, safety features, and youthful appeal are making it a preferred choice for young, urban buyers, challenging the Swift’s dominance in this segment.

Why Maruti Isn’t Making a Punch Rival!

Interestingly, Maruti has chosen not to develop a direct competitor to the Punch. The reason is strategic. Introducing a Punch-like vehicle under its brand could cannibalize the Swift’s sales, potentially damaging its strong brand value.

This hesitation stems from lessons Maruti learned in the past. When it introduced the Zen, it became a cult favorite. However, its sales began to dwindle with the arrival of the tallboy WagonR, which ate into the Zen’s market share. To make matters worse, Maruti launched the Estilo, a tallboy hatchback meant to fill the Zen’s shoes. Instead, the Estilo flopped, becoming a misstep that further cemented the WagonR’s dominance while burying the Zen brand altogether.

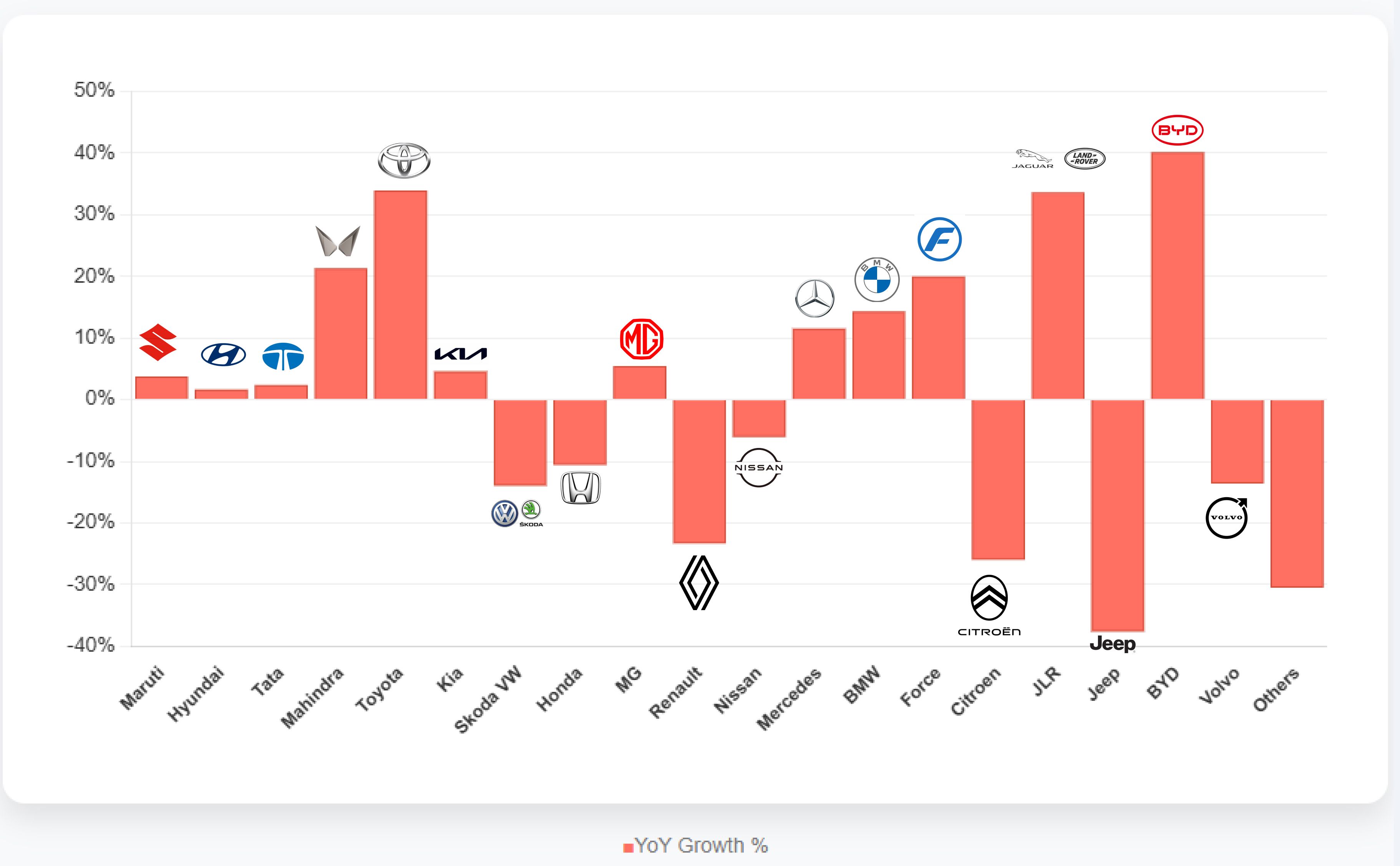

YOY growth kings: Those who achieved more than 20% growth in 2024

Mahindra's growth in 2024 is nothing short of remarkable, with 490,169 units sold, marking a 21.2% increase from 2023. This surge highlights the brand's ability to remain a dominant force in the SUV market, with the Scorpio and XUV series leading the charge. Mahindra captures around 12% market with these sales figures.

However, when looking at Toyota's performance, the growth becomes even more impressive. In 2023, Toyota sold 193,285 units, but in 2024, that figure rose to 258,164 — a substantial 33% increase. At this number, it has around 6% market share.

BYD, a rising player in the EV space, is also showing impressive growth. In 2023, it sold just 2,012 cars, but in 2024, that figure jumped to 2,818 — an impressive 40% increase. While Maruti might still outsell BYD in a day, the electric vehicle giant’s growth trajectory is something to watch closely.

Brands Struggling to Keep Pace

While several automotive giants are seeing impressive growth, not all brands are enjoying the same upward trajectory. For example, Volkswagen and Skoda have faced a notable decline of 13.88% in their sales figures, signaling challenges in adapting to consumer demands. Similarly, Nissan has experienced a 6% drop, pointing to competitive pressure in the market.

The most striking example of decline comes from Jeep, which has suffered a massive 37.5% drop in sales — from 7,333 units in 2023 to just 4,580 units in 2024. This marks a major setback for the brand, which was once a popular choice in the rugged SUV segment.

Surprisingly, Citroen has managed to outperform Jeep. Despite a 25% decline in sales, Citroen’s numbers show resilience, with 8,968 cars sold in 2024. A significant portion of this success can be attributed to the launch of the Citroen Basalt, which performed exceptionally well during the first two months of its release, attracting attention and generating solid sales.

Honda has witnessed a 10% decline in sales from 2023, a drop that’s understandable given the current market trends. The company continues to rely on its masterpiece, the Honda City, which remains a strong contender in the sedan segment. However, it’s important to note that the sedan category itself is struggling, with fewer consumers opting for this body type in favor of more versatile SUVs. Honda’s efforts to pivot with the Elevate SUV have not had the same level of impact.

The final table

Here you go with the statistics!